Business Taxation

We excel at preparing business tax returns for small-mid sized businesses. If you own a business, it is important that you not only have a tax preparer but a true tax partner that will be there to help you achieve your short and long-term business goals.

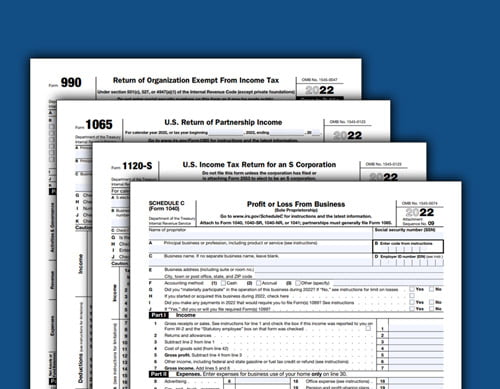

- Schedule C Proprietor

- 1120 S-Corporation

- 1120 C-Corporation

- 1065 Partnership

- 990 Non-Profit

- 1041 Trusts & more…

Business Tax Preparation

Taxes are your business’s larget expense and should be handle by a true tax professional. Business tax returns can be complex and time consuming but don’t worry, that is were we excel! We will help you file your corporate, partnership or non-profit tax return accurately and on time. Our goal is to minimize both your corporate tax and passthrough tax so that you can put more money back into your business.

Schedule C Sole Proprietor

1120 S-Corporation

1120 C-Corporation

1065 Partnership

990 Non-Profit

1041 Trust

Bookkeeping/Payroll

Tax preparation and tax savings starts with keeping good books. If you are struggling to keep accurate and up to date books, we got you covered. We offer an affordable bookkeeping solution to track all money coming in and going out of your business. We will make sure every dollar is accounted for in accordance with IRS/GAAP accounting standards. Ed Wingfield is a QuickBooks Certified ProAdvisors (advanced) and QuickBooks Payroll Certified.

- Monthly Bank Reconciliation

- Revenue & Expense Tracking

- Manage Accounts Receivables

- Manage Accounts Payable

- Monthly Statements (P&L, Bal)

- Payroll Processing W2, 1099

- And much more…

Pricing

Tax Preparation: According to the latest pricing survey done by the National Society of Accountants (NSA), the average cost for a corporate tax return is around $750 – $1,500 but can be as much as a few thousand dollars depending on the size and revenue of a business. We would consider ourselves to be right in the middle of the pack in terms of corporate return pricing. We offer a premium tax preparation services and price ourselves for quality over quantity. We want quality clients to whom we can provide quality service. When you work with us, you are not just another number. We will answer the phone!

Bookkeeping: Our bookkeeping starts at just $299 a month and goes up from there based on the scope of work and time your business requires. We price by the hour so that you are never overcharged for bookkeeping. We will do a 3-month pilot and then lock in your monthly price once we understand the full scope of work. Don’t over pay for bookkeeping services by going with a “tier or packaged” pricing company. We provide the exact same services and you only pay for what you need.

2023 Tax Deadlines

Individual Return Deadlines

IRS Starts Accepting Returns 1/23

’22 Individual Returns Due 4/18

’22 Extension Deadline 4/18

’22 Extension Expiration 10/16

Business Return Deadlines

’22 S-Corp/Partner Returns Due 3/15

’22 C-Corp Return Due Date 4/18

’23 1st Estimated Payment 4/18

’23 2nd Estimated Payment 6/15

’23 3rd Estimated Payment 9/15

’23 4th Estimated Payment 1/15/24

’22 S-Corp Extension Expiration 9/15

’22 C-Corp Extension Expiration 10/16